+86 0755 2301 1202

info@mightyling.com

Building 1, Zhongzhan Technology Park, No. 9 Furong Road, Tantou Community, Songgang Street, Shenzhen

According to the financial reports of upstream companies in the Mini/Micro LED industry, the industry believes that 2025 will be a major turning point since the birth of the industry: the market will shift from an investment period dominated by technology and production capacity accumulation to the future "market harvest period".

1. Demand continues to explode, and continued growth is expected

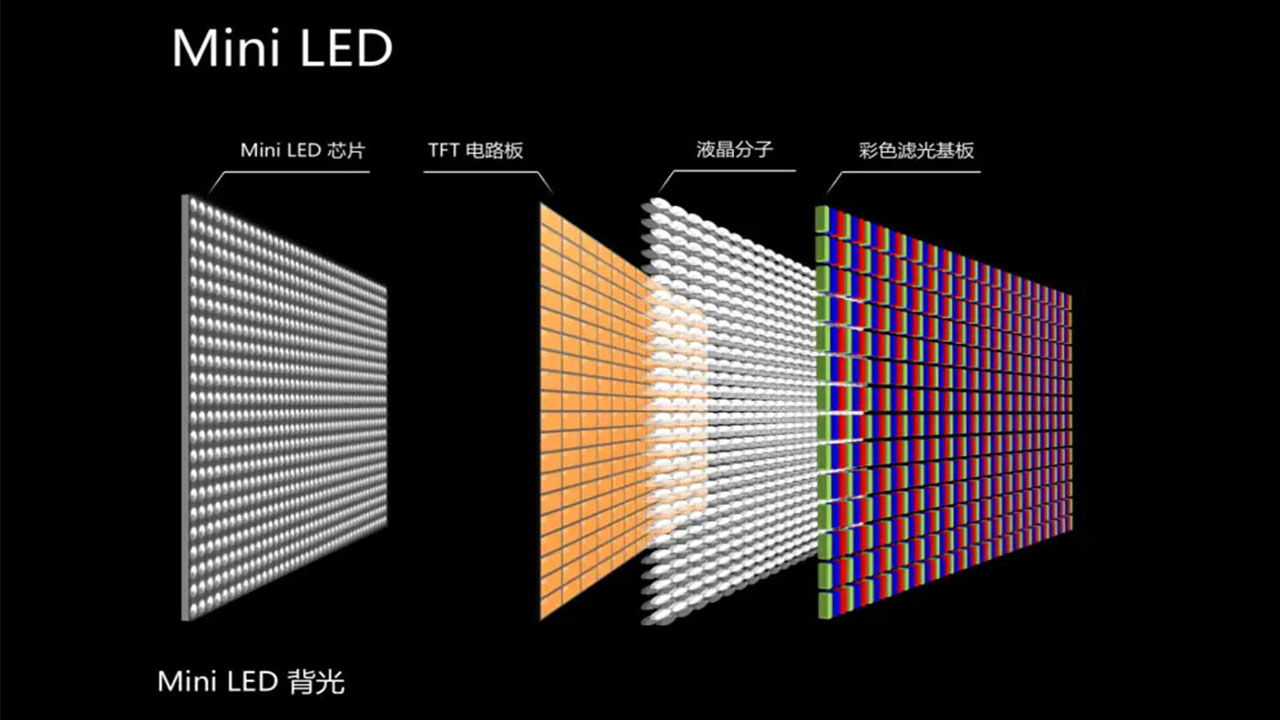

Currently, the two largest markets for Mini/Micro LED demand are LCD backlights and COB LED displays. Fortunately, both demand areas are expected to double between 2023 and 2025—a massive doubling achieved after 5-7 years of market development and based on a certain level of scale.

According to authoritative industry data, global Mini LED TV shipments will reach 7.85 million units in 2024, an 84.7% increase from 4.25 million units in 2023. The same data also predicts that the global Mini LED TV market size will surge by 70.6% in 2025, exceeding 13 million units.

Continued market demand expansion is the foundation for the Mini/Micro LED industry's performance improvement. However, while this market demand expansion has already shown explosive growth, it's only just beginning.

From the perspective of LCD backlights, there are at least four key opportunities worth seizing: First, Mini/Micro LED backlights are rapidly penetrating beyond LCD TVs into monitors, tablets, mobile phones, and automotive applications. Second, Mini/Micro LED backlights are evolving from monochrome (black and white) to RGB Mini/Micro LED color backlights. Third, in the color TV market, Mini/Micro LED backlight products are expanding into lower-tier markets. If a 50% penetration rate is assumed, the global market size will increase from the current tens of millions to hundreds of millions. Fourth, the continued expansion of color TVs, PC monitors, and other devices is increasing the demand for backlights per device.

In the LED direct display market, new demands are also emerging. These include: First, the penetration rate of Mini/Micro LED COB products continues to rise, with a projected increase from one-third in 2025 to over two-thirds around 2030 – after all, the performance improvements brought by ultra-high-definition resolution and laminated surface treatments are extremely attractive; Second, MIP technology is driving smaller Mini/Micro LED products towards the P1.5-3.5 pitch index, as well as penetration into new application markets such as MIP-COB fine-pitch products; Third, Mini/Micro LED direct displays are entering new scenarios such as automotive applications, such as TCL Huaxing's 14.3-inch Micro LED HUD display, opening up new demand – global automotive display panel shipments are forecast to maintain a high growth rate of 5.4% in 2025, reaching 250 million units, showing great potential for Micro LED products; Fourth, in the global market, Mini/Micro LED direct displays, leveraging AI and digital technologies to drive demand for public displays, are becoming a key beneficiary of humanity's "digital intelligence" journey...

"The current annual actual demand increase is already quite considerable. It is no longer the pattern of high growth with a low base and limited total pull in the first few years. At the same time, the future potential space, including certainty space and native development space, is even greater..." Industry insiders pointed out that the market of the Mini/Micro LED industry is entering the "main incremental stage."

2. Technology and cost maturity coexist with demand exploration innovation

The explosive growth in Mini/Micro LED market demand is inseparable from the increasingly mature industry chain and the continued decline in costs. It is reported that the unit application cost of Mini/Micro LED has decreased by at least 60% over the past three years. This combination of improved cost competitiveness and superior user experience has driven its widespread penetration in multiple application markets, including LCD backlighting and COB direct displays.

However, the technological potential of Mini/Micro LED remains at a stage where it warrants continued development. On the one hand, there is still room for further cost optimization and performance improvement in areas such as materials, processes, particle size, luminous efficiency, packaging structure, and optical design. On the other hand, from an application perspective, more new application categories and scenarios are rapidly emerging, requiring breakthroughs in application-layer technology.

For example, Mini/Micro LED transparent displays and holographic display products in multi-layer transparent packaging, as well as panelized display products in TFT-based packaging, are still at the prototype stage but have the potential to become market hits in the future. Furthermore, Mini/Micro LED outdoor direct displays, combined with solar technology, achieve integrated display and energy design, enhancing product engineering flexibility and eco-friendliness. From a market perspective, Micro LED-MIP products were initially designed to rapidly implement fine-pitch LED direct display applications. However, market practice has proven that MIP packaging also holds great potential in P1.5-3.5 specifications, even in outdoor applications. Large-pitch products have become a key target market for Micro LED-MIP.

In addition to innovations in direct display, RGB backlighting will usher in a new wave of technological advancements and energy-saving innovations in backlighting. Furthermore, the introduction of HDR zoned backlighting technology in smaller LCD panels (such as those in handheld or automotive applications) often requires smaller LED structures and higher luminous efficiency. The future integration of Mini/Micro LEDs with new materials such as quantum dots and perovskites will also drive enhanced backlighting and direct display experiences.

In short, the maturity of Mini/Micro LED technology is primarily reflected in one or two markets and in upstream and midstream process technologies. However, the industry is only just entering its "startup phase" in terms of downstream application innovation, integration with new scenarios, new materials, and other related technologies. This is precisely why the industry believes that Mini/Micro LED will inevitably experience a continuous and continuous "explosion of demand" across various application areas in the future.

Industry Spotlight | Why has COB/MiP seen a significant increase in market share within a year?

Industry Focus | Conference all-in-one machine and poster screen: a powerful engine driving the industry's 8.1% growth

Mengling is a global provider of LED displays. We show premium technology with cutting-edge technology and advanced innovations, providing LED display products, solutions,and services worldwide for rental stage events, ads billboards, commercial display, etc.

Building 1, Zhongzhan Technology Park, No. 9 Furong Road, Tantou Community, Songgang Street, Shenzhen